“It’s not how much you make, its how much you keep.”

Though I like that phrase, I think it can be improved.⬇️

“It’s not how much you keep, it’s how much you invest‼️”

The goal is simple:

Earn money ➡️ Buy assets with earned money ➡️ Hold the assets

The mistake is thinking your wealth is in your income. Wealth is in the assets you buy with your income but can hardly be achieved with the income you earn.

There are two reasons assets possess the ability to build wealth rather than income: Growth and Taxes.

Growth

The typical raise people get at work is 4%.

The typical salary increase for a promotion is 10% (average time frame is every 3 years).

The typical salary increase for leaving and joining a new company is 13%.

The S&P 500 averaged an annual return of 11.66% since 1928 (including reinvested dividends).

Let’s look at a comparison between investment and salary growth.

I’m comparing an investment portfolio of $50k invested in an S&P 500 index fund earning 10% annually against a salary of $100k with 4% annual raises, a promotion every three years (10% increase), and an increase do to leaving for another job every 10 years (13% increase), over a 35 year period.

Even with starting at 50% less, at the end of 35 years, the investment portfolio would have $1.4M while the salary is earning $886k.

NOTE: this illustration is generous in assuming someone would continue to earn these raises every 3 years along with promotions and new positions. The top 1% of earner sin the US earned at least $787k. A salary this high is not likely for most. Remember, this is just an illustration.

Taxes

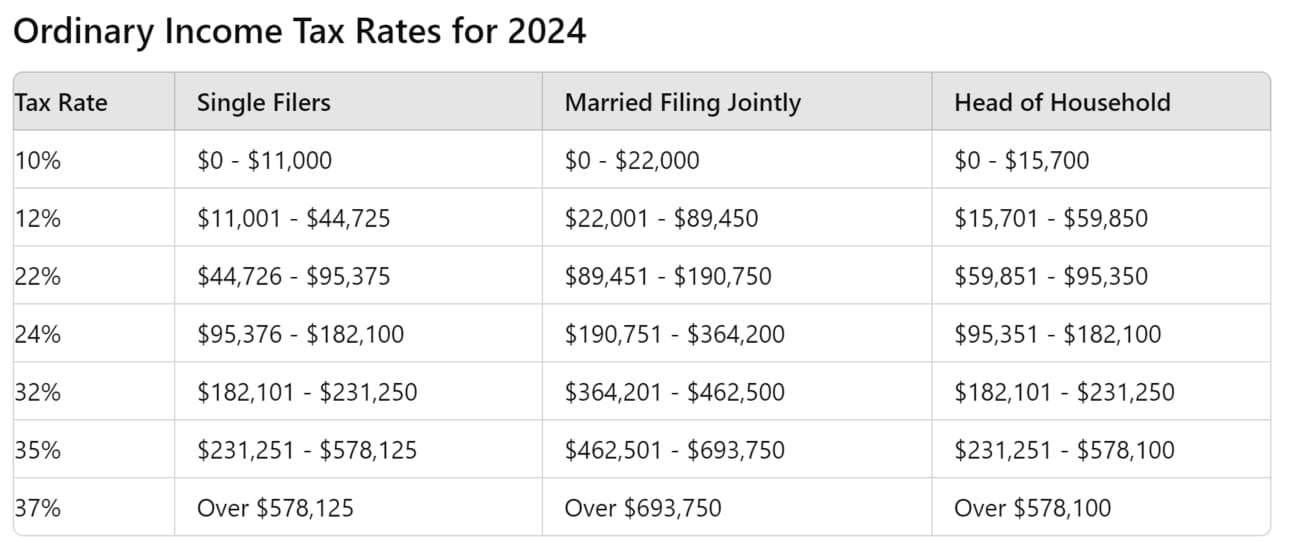

The second reason wealth is in your assets and not your income is the higher taxes on your earned income. The IRS rewards those who invest vs those who simply earn. Check out these tables that illustrate how much more you’re taxed on earned income (ordinary income) than you are with passive income (long-term capital gains).

Here’s what you must know. Taxes are a part of the fiscal policy of the U.S. When there is a smaller tax or a tax break for certain activities, our government is incentivizing its citizens to partake in that activity.

Less taxes for investors means the government wants you to invest and rewards you for doing so. Investors are seen as people who stimulate the economy by providing jobs and upholding our economic structure with your investment. Therefore, capital gains from investments are taxed at much lower rates.

The Bottom Line

You are rewarded for the risk you take. Investors and owners are considered to be taking more risks than employees.

Since these are the rules of the game, position yourself to win! Invest as much earned income as you can to have assets building as much wealth as you can. Buying stock is the easiest way to begin taking on more risks.

Earn money ➡️ Buy assets with earned money ➡️ Hold the assets ➡️ Allow the assets to compound ➡️ Benefit from lower taxes ➡️ Become Wealthy