When you’re planning your dream lifestyle, it's essential to go beyond thinking about your current financial situation. You need to consider what your future looks like, how you'll support it financially, and ensure that you're preparing for the major expenses along the way. Here are 9 important factors to keep in mind when building a lifestyle that aligns with your goals and dreams.

1. Retirement

What does retirement look like for you? Will you retire early, on time, or perhaps later because you enjoy working? It’s not just about getting to retirement but surviving it comfortably. You’ll need to account for medical expenses, travel, and possibly supporting family members. Your retirement plans determine how much you need to save and invest today. If early retirement is your goal, you’ll need to allocate more to your retirement accounts now.

2. Education

If you have kids, education costs are something you can’t ignore. College tuition has increased by 175% since 2000, and this trend is likely to continue. You must plan for these rising costs by saving early. Consider how much you want saved by the time they step onto campus, and remember that you’ll only need to worry about paying for year one when they first start. Keep the rest invested to continue growing during their time in school.

3. Vehicles

Cars are a major cost that can wreak havoc on your budget if you’re not careful. On average, new car payments are around $750 a month, and insurance and fuel costs keep rising. Plan ahead for how often you’ll buy a new car, what kind of down payment you’ll need, and how much your monthly payments will be. Stick to a budget that ensures your car expenses don’t derail your financial goals.

4. Vacations

Vacations are important for mental health, stress relief, and family bonding, but they can also lead to debt if not planned carefully. Rather than booking last-minute and putting expenses on a credit card, plan your vacations ahead of time. Set aside money monthly for two vacations a year—one international, one domestic—so you can enjoy your trips without financial stress.

5. Weddings

Weddings are expensive, often ranging from $14,000 to $49,000, and many couples go into debt to fund their big day. While it’s a special event, it’s essential to plan for the costs early. Don’t put yourself or your family in financial stress for one day. Create a savings plan that allows you to enjoy your wedding while staying financially stable.

6. Properties

Whether it’s your primary residence, investment properties, or a vacation home, real estate requires careful planning. Think about down payments, renovations, and property taxes. Are you planning on buying a vacation home in retirement? Start setting aside money now, whether it’s for a future home purchase or home improvements.

7. Asset Purchases

Big-ticket items like boats, RVs, or luxury watches can be part of your dream lifestyle, but they also require planning. Even if you can’t afford them now, put these purchases into your financial plan and start saving for them. This way, you can enjoy them without financial stress.

8. Gifting

What kind of giver do you want to be? Whether it’s for charity or for gifts to friends and family, gifting should be part of your plan. You don’t want to be caught off guard when birthdays or holidays come around and have to dip into your savings to afford gifts. Make gifting part of your financial plan so you can give generously without putting your finances at risk.

9. Legacy

What do you want to leave behind for your family? Whether it’s land, a vacation home, or a dividend portfolio, your legacy should be part of your financial plan. Consider setting aside money for investments that you won’t spend but will pass down to future generations.

Your dream lifestyle is attainable, but it requires planning and discipline. By incorporating these 9 factors into your financial plan, you can ensure that you not only reach your goals but live the life you envision—without financial stress. Take the time to plan now, and you'll be able to enjoy the rewards in the future.

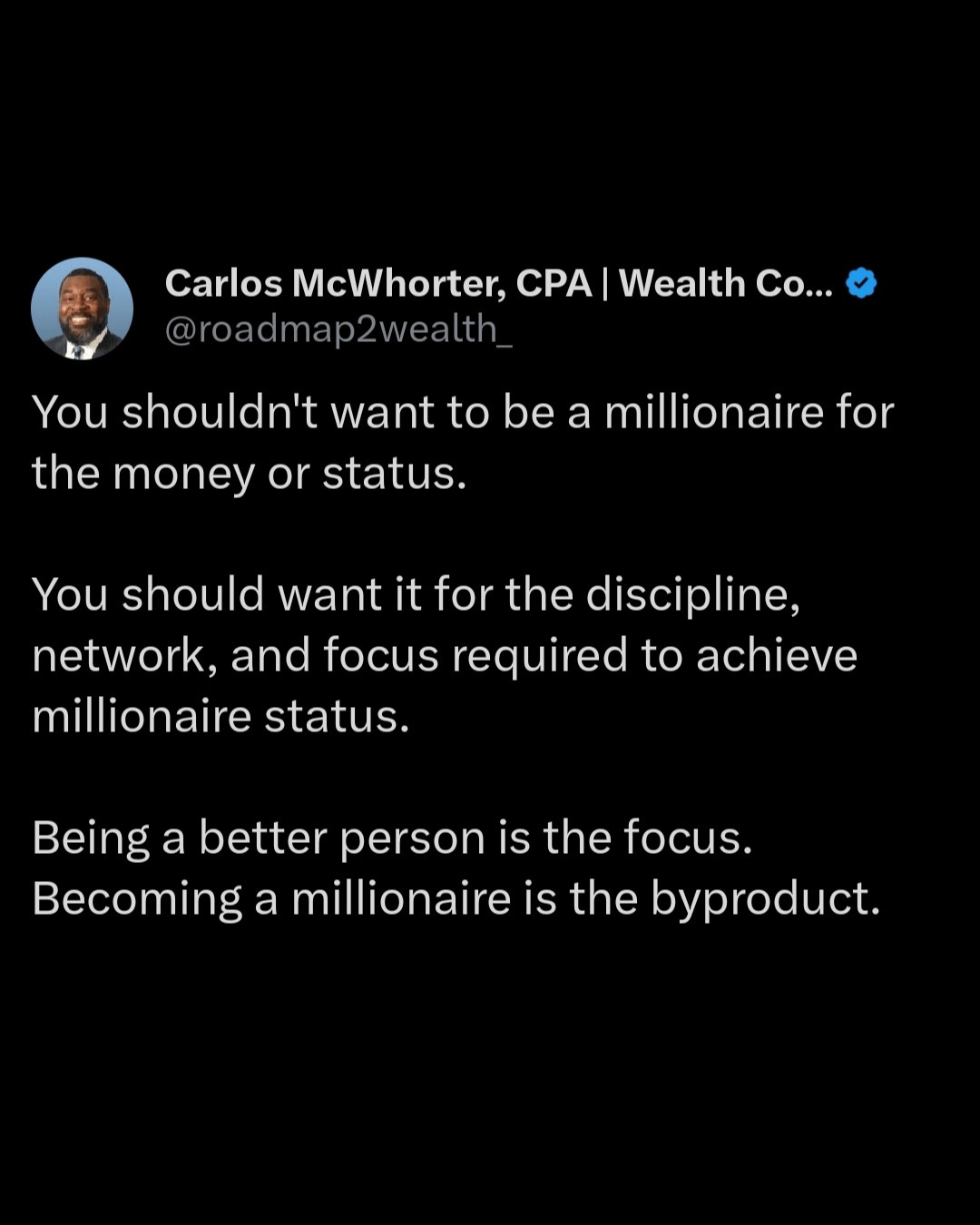

Tweet of the Week