40% of Americans are projected to run out of money during retirement. Imagine your retirement nest egg, saved and planned for, just not being enough! This can happen with poor planning. Poor planning comes from not knowing exactly how to prepare for retirement. There are numerous risks to your retirement portfolio. Inflation risk is the threat that will always have an impact no matter when you retire.

Inflation is the stealthy thief that quietly erodes the value of your hard-earned money. 🦹🏽

The Mistake: Not thinking about the thief 🧠

Thinking of retirement in today’s costs is where people shoot themselves in the foot. This is an easy mistake to make. We know inflation is a factor but nobody takes time to think: Exactly how much will life cost in the future?

Without a clear picture of what future costs will be, its difficult to put a plan in place that will ensure you have enough.

How fast the thief steals your buying power 📉

The inflation rate averaged 3.76% from 1960-2022. We can assume inflation will remain close to this average in the future. Everything that is likely to happen in the future has happened during these 62 years (recessions, bull markets, wars, presidential elections, technological changes, etc.).

I use the Rule of 72 in this scenario. My goal is to see how long it takes for the cost of living to double due to inflation.

The rule of 72 explained: if you take a stated interest rate and divide 72 by that rate, the result will tell you how many years before an investment doubles in value.

Ex: An investment yielding 8% will double in value in 9 years (72 / 8 = 9 years).

Now that you understand this trick, let’s apply it to the average inflation rate to know how long it takes for costs to double.

72 / 3.76 average inflation rate = 19.14 years for the average cost of living to double!

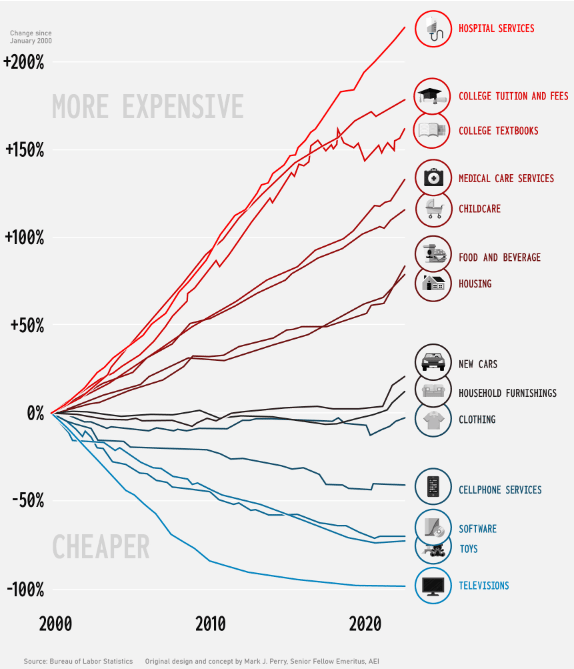

Note: This is the rate that the average cost of living will increase. In this chart below, you can review the cost increase of different categories form 2000-2022.

Prepare for the thief

The #1 way to combat inflation for a future retirement is to invest more money. An investment increase of only 1% of your salary can go long way.

Age | Salary | $ Per Week | More $ @ Retirement |

|---|---|---|---|

35 | $60,000 | $12/wk | $85,492 |

45 | $70,000 | $14/wk | $42,925 |

55 | $80,000 | $17/wk | $16,779 |

Assuming a retirement age of 67, an investment growth rate of 5.5%, and salary growth of 4% per year, we can see that a small contribution of 1% of your salary can make a difference in your retirement portfolio.

Inflation is definitely something to be concerned with but nothing to fear if you’ve properly planned. Always remember how small sacrifices leads to large amounts of money in the future! 🚀📈