Most people make the mistake of not approaching risk correctly. We either ignore risk or we totally avoid it by not investing. The goal is to have a healthy knowledge and approach to risk. Without that, you’ll never have your money in the appropriate investments to achieve your goals.

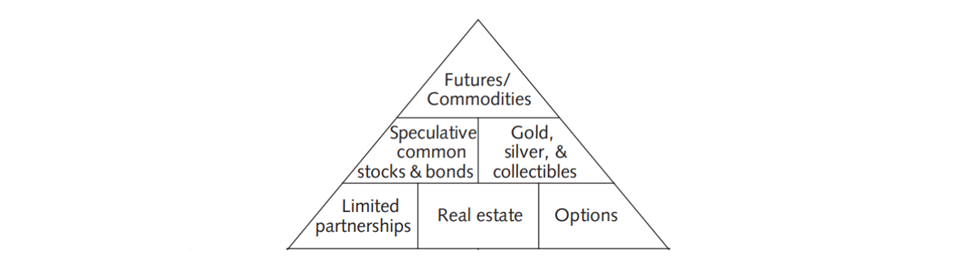

We think investing is only about picking the right investments. A more sophisticated investor prioritizes time in the market over picking the right stocks. The best investor has the ability to evaluate risk. The Risk-Return Pyramid is a great tool to evaluate the amount of risk our portfolio is exposed to.

Let’s dive into the pyramid and determine which investments expose us to the right risks.

This pyramid identifies the types of investments and their risk to reward relationship. The most important takeaway is that no investment category is inherently bad. There may be some that don’t fit what you’re trying to accomplish. This would be due to the risk being to high or the potential for gains being too low. Balance is the key. ⚖️

Tier 1: The Foundation 🏗️

The bottom of the pyramid is where the safest investments are. These present the lower potential for capital gains but with the greatest safety for your capital. 🔒 These accounts are designed to keep up with inflation or to be liquid, readily available for you to access.

What should be invested here?

Emergency fund: 3-6 months of living expenses

Short-term needs: Cash you will need in 3-5 years or less

Upcoming significant expenses: Weddings, home purchase or renovations, new car, etc.

Note: As you get closer to the time you know you’ll need cash, reduce the risk of not having that cash when you need it. You should begin to rotate cash from other investments to these types of investments with less risk. If you don’t want to sell stocks for upcoming needs, you can invest more of your income for this purpose.

Tier 2: The Bulk

This is where most of your money should be. This category includes the typical stocks and funds you’ll find on any investment platform such as Fidelity or Schwab. These present moderate risk for moderate rewards. This is not a bad thing! The moderate rewards (8-12% of compound annual growth rates) in these investments are plenty enough to build wealth. The best part is, you don’t have to assume a ton of risk to reach your wealth goals.

What should be invested here?

Dividend Portfolio

Legacy Investments: the amounts you want to leave behind

Retirement (401K, IRAs)

Long-term goals (5+yrs)

Tier 3: Alternative Investments

Alternative investments are any assets that aren’t stocks, bonds, or cash. These include private equity, venture capital, hedge funds, art and antiques, commodities, and derivatives (options). Cyrpto, crowdfunding for startups, and investing in your friend’s business idea are also alternative investments.

These present the highest risk but with the highest potential for capital appreciation. Of course, the risk takers and aggressive investors flock to these type of investments seeking the fast gains.

What should be invested here:

Money that can be lost. Most of the investments in these types of equities are not winners. The people who utilize them properly understand this and can live with the many losses for the few, potentially large gains.

Note: Only invest in alternative investments if you have the tiers 1 and 2 figured out, meaning you have proper positioning for your short and long-term cash needs and investing goals. And you can afford to lose the money. Both financially and emotionally.

Understanding and effectively managing risk is essential for successful investing. The Risk-Return Pyramid provides a valuable framework for evaluating the risk-to-reward relationship of different investment options. By diversifying across tiers, from the safety of Tier 1 to the growth potential of Tier 3, investors can build a well-rounded portfolio that aligns with their financial goals and risk tolerance. Remember, staying disciplined in your investment approach will ultimately lead to long-term financial success.