The most important investing lesson you can learn is:

It is not your knowledge that makes you successful. It’s your ability to control your emotions.

Most people believe they can consistently make investment decisions without their emotions kicking in. The fact is, unless you’ve focused on keeping emotions out of your decision-making process, you’re likely being influenced by them.

You are either unaware or make excuses by justifying the emotional decisions. Convincing ourselves of our “smart” decisions when they’re in fact driven by fear or greed.

We only accomplish the proper way to make investing decisions by having a process to review the facts and allow those facts to frame our mindset towards investing.

These are the main instances where you need to control your emotions and make rational, fact based investing decisions:

Initial Public Offerings

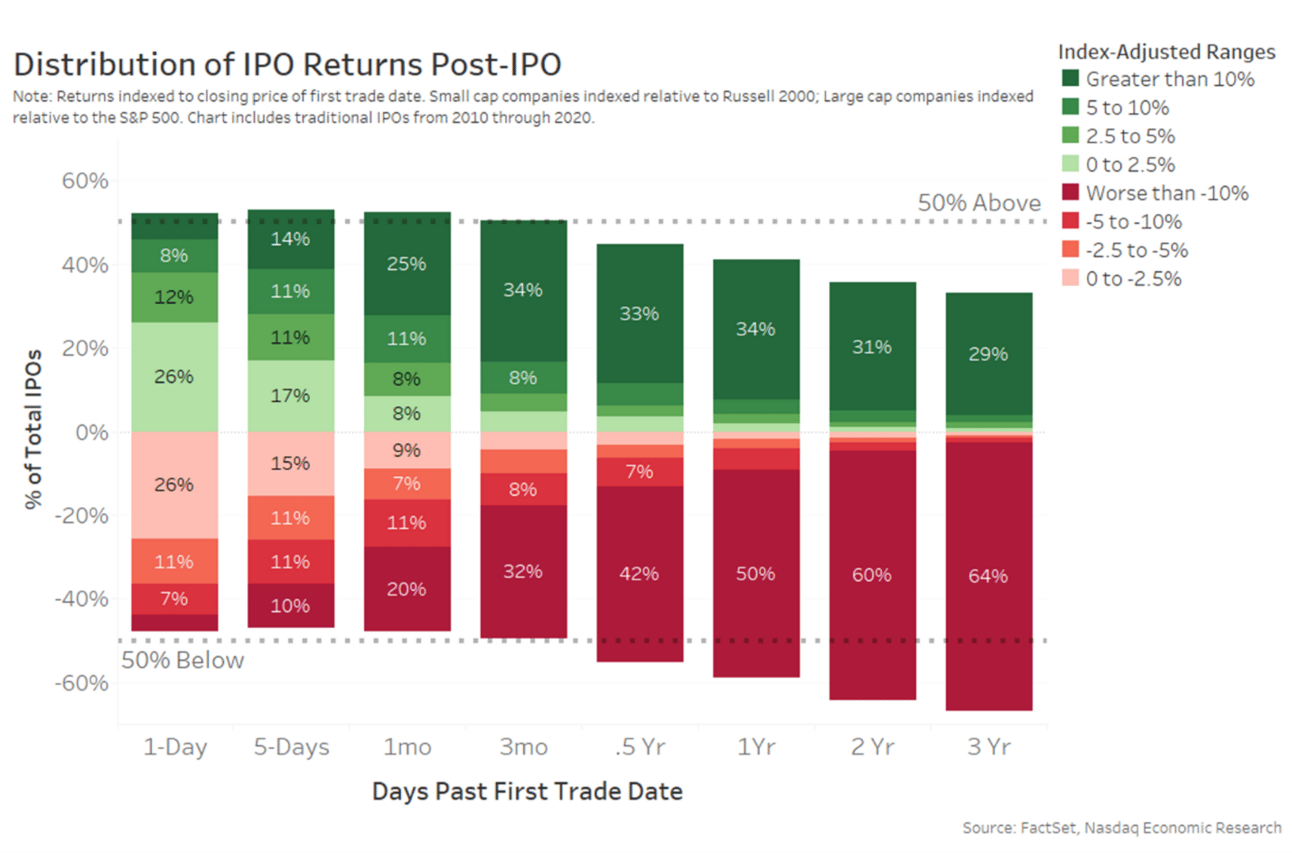

An IPO is when a business first sells ownership shares to the public. Many are announced with much anticipation and coverage from news outlets. Investors are excited to grab a piece of a popular business. In recent years, Airbnb, Coinbase, and Peloton were popular IPOs that investors grabbed with excitement only to be disappointed with the actual results of the business.

Facts:

64% of IPOs outperform the market in their 1st 3 years.

When companies IPO, you don’t have knowledge of their actual business results. They don’t release financial statement information form the years they were privately owned. You are buying blind.

There will ALWAYS be opportunities in the future where you can evaluate the company’s performance and buy shares once they’ve proven to be consistently profitable.

Action:

Only invest in established, proven companies. You don’t have to guess if a company will succeed. There are too many great companies, proven to be dominant and grow their profits.

Bear Markets

Selling stocks during a bear market is the #1 killer of wealth. When stocks are trending down, the natural fear of losing money kicks and panic-selling becomes a huge temptation.

Facts:

The truth is, bear markets are temporary and typically not very long.

With a Recession: 9 months

Without a Recession: 7 months

Action:

Hold on to what you own and invest more during bear markets. Only sell when the business no longer has a competitive advantage: competition overtakes them or technological change disrupts the industry, causing them to no longer be the dominant player you invested in.

Bad News

Often, news about companies appear to be troubling to the investor. For instance, the recent, major news about Apple is how Samsung is the new market leader in cell phone sales. The emotional investor may see this as a sign to bail. A fact-based investor will understand Apple has 5 segments of revenue (iPhone, Mac, iPad, Wearables, and Services). No longer being the market leader in cell phone sales doesn’t mean they can’t regain that crown. It also doesn’t mean Apple has to depend cell phone dominance to continue to be a dominant business. Services is actually their faster growing segment.

Fact:

News outlets have the goal of getting the most views and engagement. They are not your financial advisor. Your best interest is not theirs. Their job is to make each headline powerful enough to get your attention and often, get you emotionally vested in the story.

Action:

When news gets your attention, take a look at the financial results and focus on the actual performance of the business. This will ensure your decisions are based on what you need to know, not what others say.

I've always said, the key organ here isn't the brain, it's the stomach.

When things start to decline – there are bad headlines in the papers and on television.

Will you have the stomach for the market volatility and the broad-based pessimism that tends to come with it?

- Peter Lynch

Knowledgeable investors will always underperform the investor that may not know as much, but understands how to keep their emotions in check.