The market is down -3.2% so far this month and investors are in a frenzy trying to figure out what they should do next. Everyone knows panicking is the wrong thing to do but it’s difficult to stay calm with no gameplan.

You can’t have a gameplan without careful consideration of what’s happening in the market and what’s likely to happen next.

History doesn’t repeat itself, but it does rhyme.

I think a brief look at history will put everyone at ease.

The Market’s Best Months

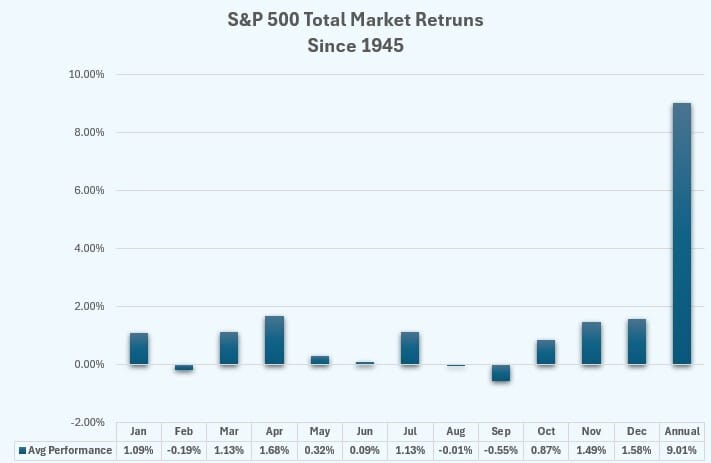

April | 1.68% |

|---|---|

December | 1.58% |

November | 1.49% |

It is believed that April’s leading market performance is due to money flowing to the market from individual’s receiving their tax refunds. Also, businesses are communicating their renewed, positive messages regarding their economic outlook. This gives a slight boost to the optimism of investors.

December’s high performance is due to tax planning and holiday spending boosts. Businesses will spend to lower tax liabilities while everyone is shopping for the holidays. This leads to a general optimism investors have during November and December.

The Market’s Worse Months

September | - 0.55% |

|---|---|

February | - 0.19% |

August | - 0.01% |

August and September are historically low performers due to lower activity and investors being more cautious after summer vacations. Fund managers are selling low performing stocks, cleaning up their portfolios for the year. Since they are trading millions of shares at a time, this creates a selling pressure that buyers typically can’t meet, lowering market prices.

During election years, the market tends to have a good month in August due to more discussions and optimism about economic activity and fiscal and monetary policy.

With all the ups and downs, remember the S&P 500 is up 68% of the years it has existed and has averaged over 9% annually since 1945.

The goal is to know what to expect. This aids in staying calm during market swings. The goal isn’t to be too active with your investing. Many “investors” end up trading stocks due to hyperactivity driven by their emotions. Trading when you intended to invest typically means you’re losing money in the market. The chart above shows that holding through the volatility will average around a 9-10% return.

Diversification: Consider diversifying your portfolio to mitigate risks associated with market downturns in these months.

Dollar-Cost Averaging: Continue investing consistently through these months to take advantage of potential market dips.

Long-Term Perspective: Keep a long-term focus, recognizing that short-term volatility is part of the market's natural cycle.

While certain months show historical trends of underperformance, it's essential to focus on long-term goals rather than trying to time the market. Market timing can be risky, and sticking to a well-thought-out investment strategy often yields better results over time.

The Investing Department

The Investing Department is where I perform a fundamental analysis of a company and my opinion on the quality of the company and if I deem it a good investment or not. This week’s stock is Intel ($INTC).

View the $INTC stock analysis here!

Description:

Intel Corporation is engaged in designing and manufacturing of semiconductors. It operates through three segments: Intel Products, Intel Foundry, and All Other. Its Intel Products segment includes Client Computing Group (CCG), Data Center and AI (DCAI), Network and Edge (NEX). The CCG is focused on long-term operating system, system architecture, hardware, and application integration that enable PC experiences. Its DCAI segment offers workload-optimized solutions to cloud service providers and enterprise customers, along with silicon devices for communications service providers. Its NEX segment helps networks and edge compute systems from inflexible fixed-function hardware to general-purpose compute, acceleration, and networking devices running cloud-native software on programmable hardware. The Intel Foundry segment comprises Foundry Technology Development, Foundry Manufacturing and Supply Chain, and Foundry Services organizations. All Other segments include Altera, Mobileye, Other.

Revenue Trends:

$INTC’s revenue has been plummeting over the last three years due to a lack of innovation and major changes to their strategy. Intel is focusing more heavily on the manufacturing of computer chips instead of mainly designing them. This is great for national security as the US needs less dependency on foreign countries to produce chips used on US soil. Analyst estimate a major increase in revenue over the next 16 months. However, they don’t project that Intel will be able to sustain that trend. The future revenue trends are very uncertain. It’s difficult to determine the scenario that’s most probable to occur.

Year | Revenue (thousands) | % Change YoY |

|---|---|---|

TTM | 55,121,000 | 2% |

2023 | 54,228,000 | -14% |

2022 | 63,054,000 | -20% |

2021 | 79,024,000 | 1% |

2020 | 77,867,000 | 8% |

2019 | 71,965,000 | 2% |

Free Cash Flow:

(Cash generated from business operations - property and equipment purchases)

Uses of Free Cash Flow:

1. Reinvestment in the business

2. Pay off debt

3. Acquisitions

4. Pay dividends to shareholders

5. Buying back shares of the business (increasing value to the existing shareholders)

Same story as with revenues. The last three years has been rough for Intel as they invest heavily into building more US based chip manufacturing plants. Though it could be expected for cash flow to be constricted, many investors didn’t think it would take such as hit when considering the size of the business.

Year | Free Cash Flow (thousands) | % Change YoY |

|---|---|---|

TTM | (12,584,000) | 12% |

2023 | (14,279,000) | -48% |

2022 | (9,617,000) | -205% |

2021 | 9,127,000 | -56% |

2020 | 20,931,000 | 24% |

2019 | 16,932,000 | 19% |

Balance Sheet

Debt to Free Cash Flow: How fast can the company pay its debt with its current amount of free cash flow? A good range is 3-5 years or less.

Debt to Equity: How much debt is on the books compared to the ownership value of the company. 25% or less is a great place for a business to be. If a company has enough cash flow, a D to E ratio of 50% or lower is acceptable.

The balance sheet has also become worse for Intel as their debt balance has increased by 32% to $46.9 billion. This isn’t a bad thing by itself. However, the increase in debt along with the depletion of the cash source used to pay down debt (free cash flow) should have investors concerned. And they are, as evidenced by the 61.5% drop in stock price from $52.28 to $19.71 within the past year (price as of 8.11.24) .

When reviewing the debt to equity ratio by itself, Intel seems to be in a position to that could be considered ok. When considering their depleted cash flow, their balance sheet doesn’t look to be healthy.

Year | Long-Term Debt | Debt to FCF | Debt to Equity |

|---|---|---|---|

2023 | 46,978,000 | - | 44% |

2022 | 37,684,000 | - | 37% |

2021 | 33,510,000 | 3.7 | 35% |

2020 | 33,897,000 | 1.6 | 42% |

2019 | 25,308.000 | 1.5 | 33% |

5 yr Avg. | 35,475,400 | 7.7 | 38% |

Value Creation

Return on Invested Capital (ROIC): How much money a company makes divided by how much it spent to make it.

Weighted Avg. Cost of Capital (WACC): There are two sources of capital, debt and equity. The cost of debt is interest. The cost of equity is the difference between what you can earn risk free (typically bonds) and the return you can expect from investing int he stock market.

Comparing the ROIC and the WACC determines if the company is creating value with its operations. We’re looking at how much does it cost you to get the funding you need to run the business and comparing it to the returns you earn with that funding.

Intel’s performance is extremely subpar compared to the other companies in the semiconductor (computer chip) industry. 1. Intel is currently lost 7% of value last year. 2. There is a 14.9 point swing between their rate of -7.09% and the industry average of +7.81%.

Metric | Intel | Industry Avg. |

|---|---|---|

ROIC | 0.63% | 18.53% |

WACC | 7.73% | 10.72% |

Rate of Value Creation | -7.09% | 7.81% |

Valuation

Price Earnings to Growth Ratio (PEG Ratio)

Comparing the price earnings ratio to the expected growth of the company.

The PE ratio should equal the expected growth of the company if it is properly valued.

< 0.7 = Undervalued

Between 0.7 and 1.3 = Properly Valued

> 1.3 = Overvalued

Intel’s PEG ratio of 3.41 determine that the stock is extremely overvalued.

PE Ratio | 92 |

5 yr expected growth rate | 26.99 |

PEG Ratio | 3.41 |

Conclusion

Intel is a company that will not make The Investing Department’s Quality Company list. Here’s why most investors should stay away from Intel:

Declining revenues

Declining cashflow

Rising debt balances

The dividend is being cut this year to help supply cash to the new factories.

Inability to create value with their operations

Over valued according to the PEG ratio.