What is the all the craze with Nvidia?!?! $NVDA is currently priced at $826.55 per share. It’s up over 67% this year and 245% over the past year! I don’t believe a business can get actually improve by 245% in one year.

Artificial Intelligence is not new technology but its new to many who have access through platforms like ChatGPT and Google’s Gemini. Investors can now see the power and potential of generative artificial intelligence (AI).

Now the stage is set for Nvidia, the leading producer of the microchips that support AI, called graphics processing units (GPUs). GPUs are necessary for AI due to being more powerful and energy efficient than CPUs (what we use in everyday devices like laptops and cell phones).

Let’s take a look at Nvidia’s operations ⬇️

NVIDIA Stock Analysis

Nvidia has two segments:

1. Compute & Networking

77.8% of revenues from:

- Data center computing platforms

- Automated driving

- Robotics

- Cloud services

2. Graphics

22.2% of revenues from:

- GPUs for gaming and PCs

- Game streaming services

- Visual and virtual computing

- Automotive platforms for infotainment systems

- Software for building metaverse and 3D applications

NVIDA’s Competitors

- GPU suppliers: Intel ($INTC), AMD ($AMD), and Huawei (privately held, China based company)

- Cloud services: Alibaba ($BABA), Alphabet ($GOOGL), Amazon ($AMZN), Huawei, Microsoft ($MSFT)

- Automotive interface and autonomous driving: Ambarella ($AMBA), AMD, Broadcom ($AVGO), Intel, and Qualcomm ($QCOM).

- Network solutions: AMD, Arista ($ANET), Broadcom, Cisco ($CSCO), Hewlett Packard ($HP) Huawei, Intel, Lumentum ($LITE), Marvell ($MRVL)

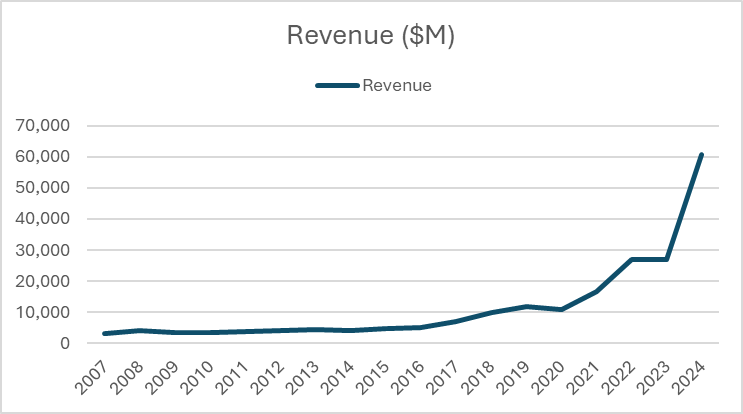

Revenues

Nvidia has experienced an immense amount of revenue growth in the past year. Many believe the revenue growth is from the boom in AI use. The truth is, the revenue explosion is from the growth in the use of data centers. As businesses transition to using cloud based servers and software, the need for data centers and the powerful GPUs are on a rise. Nvidia provides about 80% of the global GPU market, giving them an a clear advantage moving forward.

Revenue | Growth YoY | |

2015 | 4,682 | - |

2016 | 5,010 | 7% |

2017 | 6,910 | 38% |

2018 | 9,714 | 41% |

2019 | 11,716 | 21% |

2020 | 10,918 | -7% |

2021 | 16,675 | 53% |

2022 | 26,914 | 61% |

2023 | 26,974 | 0% |

2024 | 60,922 | 126% |

10yr avg | 38% | |

5yr avg | 47% |

Operating Efficiency

When a business has a competitive advantage, they can either charge more for the same product or have figured out how to provide the product at a lower costs. This is also a sign of effective management. Looking at Nvidia’s margins, we see that they have a steady increase in both gross and net profit margin. This means that they are providing their products/services for less costs. Also, note that Nvidia’s 2024 gross margin is well above the industry average of 54%.

As mentioned earlier, the data center surge has impacted Nvidia’s revenues positively. Margins are no different as data centers services are higher margin. The increase in that revenue source means less cost for the increase in revenue. A 73% gross margin means for every 27 cents Nvidia spends on producing their products and services, they make $1 in revenue.

Bottom line: Nvidia is becoming incredibly efficient as their revenues skyrocket! 🚀🚀

Note:

Gross profit = revenue – cost of product/service

Gross margin % = gross profit / revenue

Revenue | Cost of Revenue | Gross Margin % | |

2015 | 4,682 | 2,082 | 56% |

2016 | 5,010 | 2,199 | 56% |

2017 | 6,910 | 2,847 | 59% |

2018 | 9,714 | 3,892 | 60% |

2019 | 11,716 | 4,545 | 61% |

2020 | 10,918 | 4,150 | 62% |

2021 | 16,675 | 6,279 | 62% |

2022 | 26,914 | 9,439 | 65% |

2023 | 26,974 | 11,618 | 57% |

2024 | 60,922 | 16,621 | 73% |

10yr avg | 61% | ||

5yr avg | 64% | ||

Industry Average | 54% |

Debt

Next I like to evaluate the level of debt the business carries by comparing the debt to free cash flow (FCF). This lets me know how soon the business can pay off debt. Why do I look at free cash flow? FCF is the amount of cash generated by the business that is left over after the business makes it required reinvestment back into the business. FCF is what is used to pay off debt, pay dividends, make acquisitions, and buyback shares of the business.

I don’t like to invest in a business that can’t pay off their debt in less than 5 years. 3 years is the sweet spot. Businesses can hit hard times and their ability to pay off their debt will be the factor that can keep them in business when others fail.

Nvidia keeps their debt balance low relative to their FCF generation as they typically are able to pay off their debt in less than a year and a half! The FCF along with their average cash balance of $3.2 billion over the past 10 years tells me that they are a durable business, strong enough to withstand strong headwinds.

Debt | Free Cash Flow | Payoff Ability | |

2015 | 1,541 | 783 | 1.97 |

2016 | 1,510 | 1,089 | 1.39 |

2017 | 2,816 | 1,496 | 1.88 |

2018 | 2,000 | 2,909 | 0.69 |

2019 | 2,079 | 3,143 | 0.66 |

2020 | 2,643 | 4,272 | 0.62 |

2021 | 7,597 | 4,694 | 1.62 |

2022 | 11,831 | 8,132 | 1.45 |

2023 | 11,855 | 3,808 | 3.11 |

2024 | 9,937 | 27,021 | 0.37 |

10yr avg | 1.38 | ||

5yr avg | 1.43 |

Valuation

Now that we know Nvidia is a quality business, the next question is…

Is Nvidia too expensive?

It’s hard to imagine that a stock can grow 245% and still be in value territory. To do a quick analysis of the valuation, I like to use the Price Earnings Growth ratio (PEG ratio). This valuation metric compares the Price to Earnings ratio (PE) to the expected growth of the business to determine if the stock is undervalued, fairly valued, or overvalued.

PEG Ratio | Rating |

<.08 | Undervalued |

.08 - 1.2 | Fairly Valued |

> 1.3 | Overvalued |

Current PE ratio: 68.97

Growth: Nvidia is expected to grow between 36% and 50% per year over the next five years

36% Growth | 43% Growth | 50% Growth | |

PEG | 1.92 | 1.60 | 1.38 |

Even if Nvidia were to grow at 50% per year over the next 5 years, the PEG ratio shows that they would still be slightly overvalued. The conservative approach would be to make your decisions from the lower case scenario showing a 1.92 PEG, which would indicate that Nvidia’s stock is extremely overvalued.

Note:

P/E Ratio = Stock Price divided by Earnings per share

PEG Ratio = P/E ratio divided by expected growth rate

Remember: the business and stock price are two separate things. Value investors attempt to identify opportunities where the business is outperforming while the stock prices is undervalued. Nvidia is clearly outperforming but the valuation is red hot due to the popularity of AI. As Warren Buffet said, “Be fearful when others are greedy and greedy when others are fearful.” Many people lose money by chasing the popular stocks.

Disclaimer: This is not investment advice. This analysis is for educational purposes only. All investing assumes risks. Inexperienced investors should consult an financial advisor.