There was a significant downturn in the stock market this past Friday, August 2nd. At one point, the market lost $2.9 trillion in market cap! Let’s dive into what happened and what that means for all investors.

Why Did the Market Drop?

The July jobs report was released showing the labor market increased by 114k jobs. This was 36% below the expected 179k increase in nonfarm payrolls.

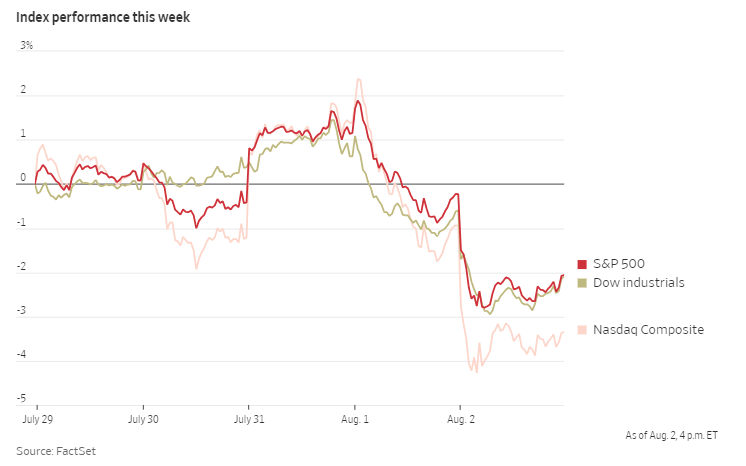

This sent shockwaves through the investing world. A slowdown in the labor market could be the initial sign of a recession that investors were looking for. This caused many investors to abandon a significant amount of holdings, leading to the worse day in the market since Covid.

The Shockwave

S&P 500 fell 1.8%

Dow Jones Industrial Average fell 1.5%

The Nasdaq composite fell 2.4%

Notable stocks taking a big hit

Amazon stock ($AMZN) fell 8.8%. $AMZN missed their revenue expectations for the quarter ending June 2024. They also expect a less favorable sales increase for the next quarter.

Intel ($INTC) fell 26%. $INTC announced they will cut their dividend this year. They plan to allocate their cash flow to building their chip building factory.

Nvidia ($NVDA) fell 7.8% over two days. $NVDA alone is responsible for 34.5% of the S&P 500 gains in 2024 due to the skyrocketing of the stock. When recession fears hit, the companies with the loftiest valuations tend to fall the fastest. Be careful chasing skyrocketing stocks!

Is the Market Overvalued?

To answer this question, I refer to the Buffett Indicator. Warren Buffett said this formula “…is the best single measure of where valuations stand at any given moment.”

This indicator compares the total value of the stock market to quarterly GDP. Basically, the value of all the businesses should equal the value of all the products those businesses produce each quarter.

Total US Stock Market Value | $53.487 Trillion |

GDP | $29.629 Trillion |

Buffett Indicator | 186% |

According to the Buffett Indicator, the stock market is Significantly Overvalued.

This means there is definitely room for a recession. This doesn’t guarantee a recession will happen or anticipate when a potential recession will occur. It just shows the market is “running hot” and suggest potential for some cooling down.

What should I do?

Don’t Panic

Understand that volatility is all apart of investing and building wealth. You must learn to hold assets during downturns to benefit from them long-term.Dollar-Cost Average

Most people should invest a set amount of money periodically. No matter what the market is doing, invest consistently. You can only fail if you don’t invest during the downturns. Always remember, if a stock is good at $100, its even better at $75. Don’t allow the fears of a falling market rob you of your opportunity, keeping you from investing with stocks are down.Cash Holdings

It’s good to have liquid cash that is not allocated to anything. You never know when the market will present opportunities you’d like to take advantage of. I’m not saying do this instead of dollar-cost averaging. I’m saying its great to both invest periodically no matter what AND be able to invest more when a stock(s) are at lower valuations.When to Sell

I wrote about when to sell a stock. check it out here ⬇️

How to Know When to Sell a Stock

The main reason to sell a stock is when the fundamentals of the business change. For instance, $INTC has made significant changes to their strategy. Instead of mainly designing chips, they’ve decided to build factories in the US to manufacture them as well. This cash intensive, long-term capital project requires them to allocate their cash flow much differently than before. Also, they’ve cut their dividend. This means this stock may no longer serve its purpose in many portfolios as a source of income. These are good reasons to sell.

The recent drop in the stock market is a reminder of how unpredictable financial markets can be. It’s important not to panic in these moments but instead use them as an opportunity to reassess your investment strategy.

Remember that market volatility is normal, and downturns are a natural part of the investment cycle. Stick to your plan, continue investing consistently, and take advantage of opportunities when valuations are favorable. By maintaining a balanced perspective and focusing on long-term goals, you can navigate these challenging times with confidence.