In This Issue

1) Market Update & Analysis

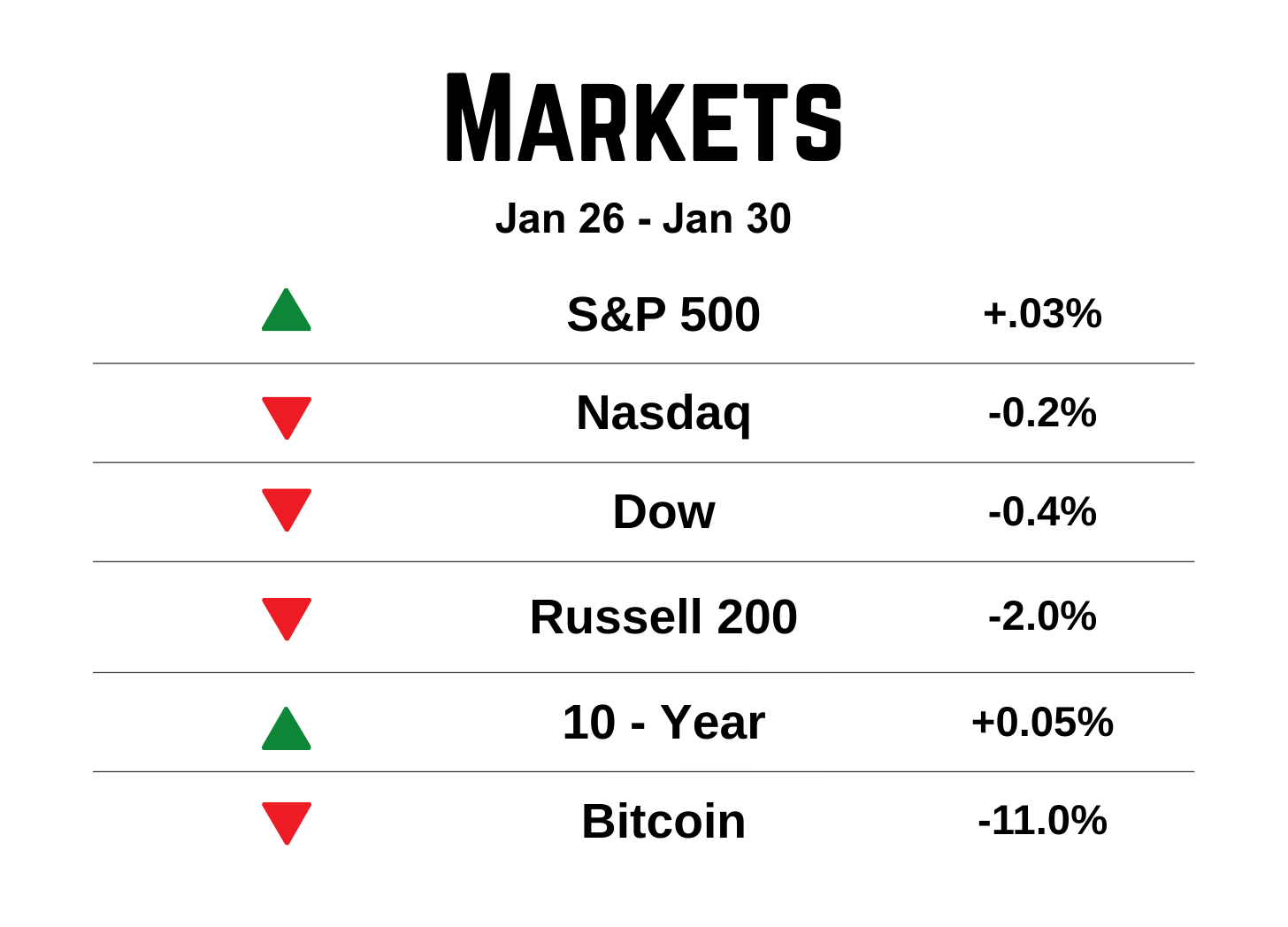

What drove sentiment this week

Rates & Fed leadership uncertainty: Trump has selected Kevin Warsh to be the new chairman of the Federal Reserve, set to take over after Jerome Powell’s term ends in May this year. The Warsh nomination re-raises questions about the Fed’s independence and future policy bias. Assets can react sharply to any signal that the Fed may prioritize growth or politics over inflation credibility.

Earnings dispersion (AI hardware > software): AI software companies received most of the praise and attention from investors as the leaders in the AI revolution as their valuations rose sharply in recent years. People are beginning to second guess the high valuations of those stocks. As the focus is shifting to the hardware companies that supply the physical elements needed to build the infrastructure, we’re seeing the software companies’ valuations soften a bit while the hardware firms are getting a strong boost in their stock price.

2.) Economic Update

Fed held rates steady: The Federal Reserve maintained the fed funds target range at 3.50%–3.75%, reinforcing a “wait-and-see” posture while inflation remains elevated. The Fed noted “Available indicators suggest that economic activity has been expanding at a solid pace. Job gains have remained low, and the unemployment rate has shown some signs of stabilization.”

Inflation ran hot: The producer price index (PPI) rose 0.5% in December. This is an indicator that the Fed should be inclined to drop interest rates later in the year, which is already expected.

What’s coming next week

Mon, Feb 2: ISM Manufacturing — a key read on growth momentum and pricing components.

Wed, Feb 4: ADP employment — labor cooling vs. re-tightening can swing rate expectations mid-week.

Thu, Feb 5: Central bank risk (BoE/ECB) — global rate differentials can ripple into USD, commodities, and multinationals.

Fri, Feb 6: U.S. Jobs Report — still the single highest-volatility macro print for stocks/rates each month.

3) Political / Policy Updates

Government funding drama: A partial shutdown risk surfaced around Friday’s deadline, with last-minute maneuvering and remaining procedural/logistical hurdles (notably House timing). Even “short” shutdowns can hit confidence and create operational disruptions in travel and certain agencies.

Student loan policy changes advancing: The U.S. Department of Education announced proposed rules that may alter borrowing limits and repayment structures for future borrowers. This matters for household cash flow concerns.

4) Personal Finance Corner

Mortgage rates: Freddie Mac reports the 30-year fixed rate at ~6.10%. Affordability remains tight; meaningful relief likely needs either lower Treasury yields or lower home prices (or both).

Tax season is open: The Internal Revenue Service says Jan. 26, 2026 is opening day for filing 2025 federal returns, and IRS Free File started earlier for eligible taxpayers. If you’re due a refund, e-file + direct deposit means a faster refund.

5) Stocks of the week

Verizon ($VZ ( ▼ 0.16% )) +12.7%: Jumped on the strength of their earnings and outlook. As valuations in the market are red hot, investors are beginning to rotate to defensive stocks. These stocks are stable companies with a strong dividend policy. Expect this investor trend to continue, at least modestly, with other defensive stocks.

USA Rare Earth Inc. ($USAR ( ▼ 1.93% )) -9.4%: This company engages in mining, processing, and supplying rare earths and other critical minerals in the United States. Rare earths supply is slim compared to the demand. Plus, China controls much of the flow of rare metals in the world. However, this company is still in the exploration stage. There are no revenues as of yet. Investors are betting this company will be profitable but that will take some time before operations are underway, capital spend is settled, and this company is producing cash flow.

Nvidia ($NVDA ( ▲ 1.18% )) : In September, Nvidia and OpenAI announced their $100B circular financing deal where Nvidia invest that money in OpenAI over time then OpenAI would buy Nvidia computer chips. Well, this deal was a nonbinding agreement. It’s been reported by The Wall Street Journal that the deal has stalled due to “doubts about the size and structure of the transaction and questions about OpenAI’s business discipline and competitive risks.”

This is a reminder of the difference between hype and fact. The deal was announced, the investing world experienced euphoria, then reality sets in. OpenAI still has $1.4 trillion in commitments between cloud partners, chipmakers and investors. Be on the lookout for other partners to drop out of their deals or restructure their commitments as the reality of the future AI driven world becomes more clear (Microsoft, Amazon, Oracle, CoreWeave, Advanced Micro Devices)

6) Chart of The Week

Bitcoin is falling like middle-aged men on their icy driveways in this week’s winter storm.

tradingview.com

This is significant. the recent rise in Bitcoin came with the rise in gold and silver in what is known as the debasement trade: Investors moving their assets that are denominated in cash to hard assets such as metal or assets that can’t be devalued by money printing, like Bitcoin. In many investors minds, this simultaneous move between the three assets solidified Bitcoin as a legit asset, worthy alternative to cash.

But in recent months, Bitcoin has been falling sharply while gold and silver have climbed, with only recent small drops due to interest rate and Fed uncertainty. This shows that the investing world, and Bitcoin enthusiast alike, still don’t view Bitcoin as having the same qualities as gold, silver, or cash.