What Will Your Retirement Look Like?

Planning for retirement raises many questions. Have you considered how much it will cost, and how you’ll generate the income you’ll need to pay for it? For many, these questions can feel overwhelming, but answering them is a crucial step forward for a comfortable future.

Start by understanding your goals, estimating your expenses and identifying potential income streams. The Definitive Guide to Retirement Income can help you navigate these essential questions. If you have $1,000,000 or more saved for retirement, download your free guide today to learn how to build a clear and effective retirement income plan. Discover ways to align your portfolio with your long-term goals, so you can reach the future you deserve.

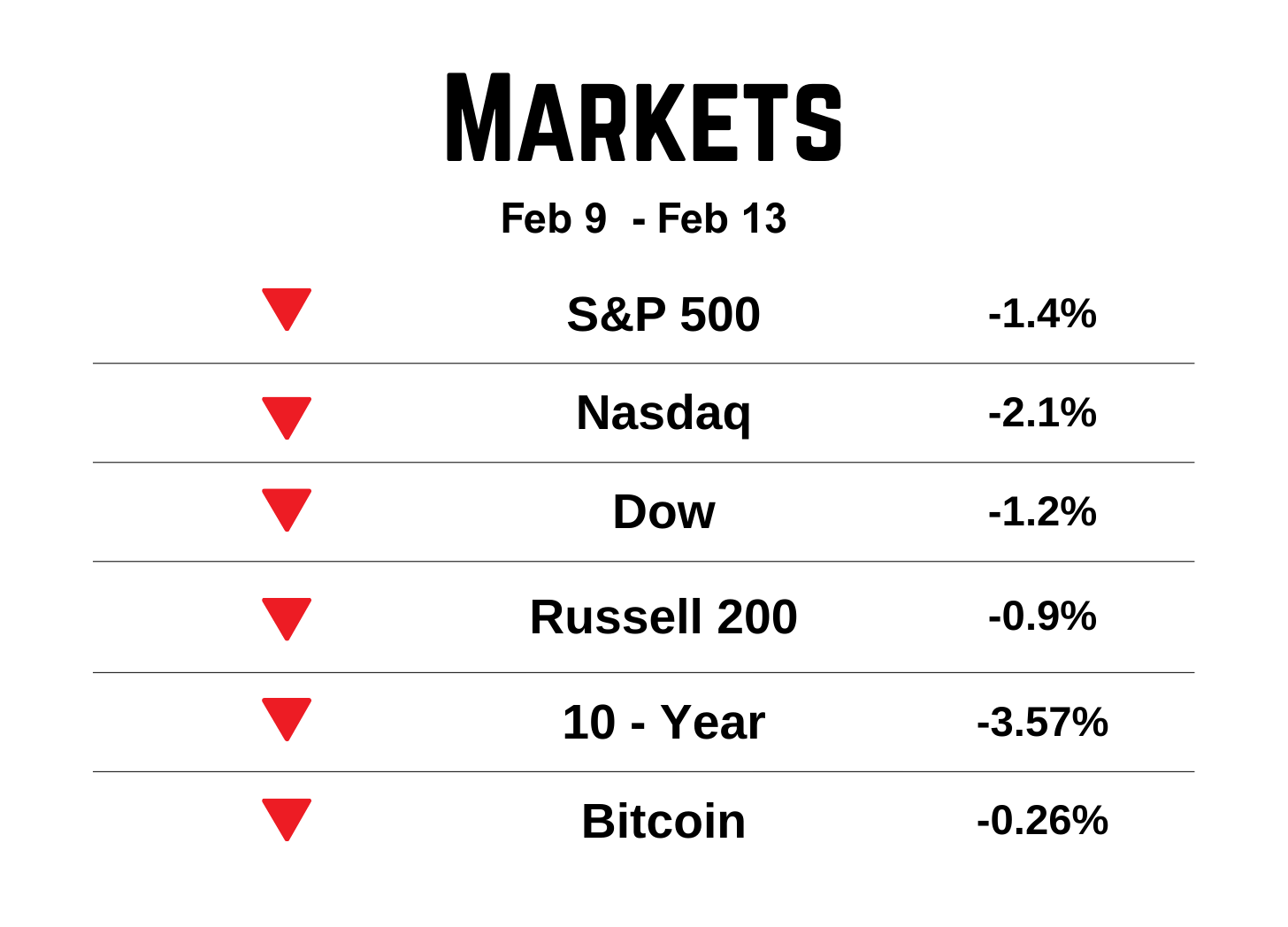

MARKETS

An AI Title Wave is On its Way!

This week Anthropic made visible what investors have been worried about for some time: The disruptive power of AI. Anthropic, the developers of Claude AI, released 11 open source plug-ins that is shaking multiple industries.

One particular plug-in was a legal prompt that could analyze non-disclosure agreements for non-standard clauses and compliance reviews. The issue isn’t that these were created, rather the concern is this plug-in is a template that is open source, available for any business to customize for their unique workflow. This decreases the cost of business for many firms that charge a premium price for these services.

The companies hit the hardest:

Thomson Reuters $TRI ( ▲ 2.99% )

RELX PLC $RELX ( ▲ 0.33% )

Ares Management $ARES ( ▲ 2.73% )

KKR & Co. $KKR ( ▲ 1.02% )

TPG, Inc. $TPG ( ▲ 2.22% )

These legal and financial analysis firms are taking a hit in the market due to this newly exposed uncertainty around their pricing models. For instance, many people won’t pay LegalZoom if they can trust AI will accurately inform them of every legal document they need for their situation and how to complete the forms.

A deeper example would be Thomson Reuters, a content and technology company which charges firms a licensing fee for each employee that has access. I used Thomson Reuters as an auditor to download workpapers and guides for testing procedures we performed. They would ensure these workpapers were updated with each new accounting ruling or development to ensure we were in compliance. What’s stopping accounting firms from hiring a development team to build and update AI models to perform the updates to the firm’s standards? A small development team could possibly handle this task cheaper than all the licensing fees paid to the content company.

Here’s the shakedown. The cost of these services are being compressed and everyone knows it. If everyone knows it costs less to complete your services, than you’re likely forced to lower your prices or change your pricing model. The risk is that companies charging a subscription can no longer reasonably predict their future revenues. If I can’t predict your revenues, then I can’t be comfortable knowing what I’m willing to pay for this stock. This fact is causing a sell off that is responsible for $285 billion of market cap disappearing over the last few weeks.

Along with the legal and financial analysis industries, homeowners insurance providers, insurance brokers, wealth management, and logistics businesses have also seen some market cap dwindle as investors are de-risking their portfolios.

IMPORTANT FINANCE/INVESTING NEWS

Pricing Power and Market Shifts

1) Firms with “Pricing Power” are winning

Growth of firms are slowing and costs are higher. In this environment, its important to pay attention to what’s coming next, not just what’s happening now. Investors are slowly leaving their AI tech/software positions and leaning into consumer staples, utilities, and industrials. These firms are seen as being insulated from being disrupted from AI and won’t lose customers if inflation gets hot again. Walmart $WMT ( ▼ 1.73% ) (up 20.18% on this year) and Exelon Corp $EXC ( ▼ 1.67% ) (up 11.2% this year) are examples of the shift in investor sentiment.

2) The market’s leadership continues to broaden beyond mega-cap tech

Mid and small cap stocks have relatively outperformed the S&P 500 over the last 6 months. We got used to the mega-cap tech led market but things are changing.

Over the past 6 months:

S&P 500: +5.72%

Russell 2000: +13.69%

This shows broader participation and a healthier market as it is turning away from heavy tech, AI concentration.

ECONOMIC UPDATE

What happened this week

Inflation cooled more than expected in January (CPI): The consumer price index (CPI) rose slightly, and the year-over-year rate slowed. Some big drivers were lower gasoline prices and easing rent inflation—but services inflation still showed persistence.

Lower inflation supports the case for rate cuts later this year, but sticky services prices mean the Fed still can’t declare victory.

What’s coming next week (Feb 16–20)

FOMC minutes (Wed): We will get more detail on what the Fed is thinking about rate cuts this year.

PCE inflation (Fri): The Fed prefers to use the personal consumption expenditure (PCE) rate to decide if rates cuts are needed. If PCE comes in hotter than expected, markets may push rate-cut expectations out; if it cools, it can support a friendlier backdrop for stocks and bonds.

CHART OF THE WEEK

Coinbase

$COIN ( ▼ 1.19% ) posted an unexpected loss as crypto trading volumes slowed during a broader digital-asset selloff and transaction revenue falling sharply year-over-year. $COIN ( ▼ 1.19% ) stock is highly correlated to crypto trading volumes but services such as Coinbase One could help stabilize the company.

To solidify their position in the market and address their falling stock, they need to do two things:

Make earnings less dependent on trading cycles.

Protect trust

Rotate earnings: Coinbase One is $4.99 per month subscription that gives access to a high yield savings account for stable coin such as USD Coin ( $USDC ( ▲ 0.14% ) ). Their subscription service held better from prior year than their trading revenue. The more they rotate their revenue source to subscriptions, the more stable and predictable their earnings will be.

Keep their customers’ trust: Platform outages, like the one experienced this week, is a trust killer. These disruptions cause too much reputational damage. Customers have many choices ( $HOOD ( ▼ 0.31% ), $XYZ ( ▲ 5.49% ) -Cashapp, $PYPL ( ▲ 1.57% ), $SOFI ( ▲ 0.15% ), etc.) and outages create a hill they won’t be able to climb.