The weeks Roadmap 2 Wealth Weekly Brief is brought to you by CoW

You're overpaying for crypto.

Every exchange has different prices for the same crypto. Most people stick with one and pay whatever it costs.

CoW Swap checks them all automatically. Finds the best price. Executes your trade. Takes 30 seconds.

Stop leaving money on the table.

MARKET

This week’s market activity

What drove the market this week:

Rotation + “old economy” leadership: The Dow surged (including crossing 50,000 intraday) while the S&P 500 was roughly flat on the week—suggesting a rotation away from the most crowded areas of mega-cap growth/AI and toward more cyclicals/value-sensitive parts of the market.

AI spending anxiety whipsawed tech: Markets spent the week repricing parts of the AI trade. Especially as investors digested big-cap tech capex expectations and “who wins” questions around infrastructure vs. apps/software. The outlook doesn’t look as bright as we thought it did over the past two years.

TOP FINANCE & INVESTING STORIES

1) Dow clears 50,000 as tech rebounds—AI spending remains the market’s “tell”

Why it matters: The week ended with a strong Dow and a tech bounce, but the Dow up (traditional stocks) while the Nasdaq went down (tech stocks) is what will eventually happen when the market is keyed on a central theme such as AI capital spending and future monetization.

Investor takeaway: Understand that “AI beneficiaries” is more than just companies like Nvidia. Think chips/infrastructure, data centers/utilities, and software/apps. At any moment, the “leaders” in AI can shift between these sectors as all of them will benefit from the obsessive focus on building AI infrastructure.

2) Manufacturing rebounds while labor indicators soften

Why it matters: The Institute of Supply Management (ISM) publishes the Purchasing Managers’ Index monthly. This key economic indicator surveys 400+ purchasing managers, gauging the health of the us manufacturing sector.

Typically, when the index rises, unemployment claims stay low or fall. If purchasing managers are buying materials for production, they will need employees to process the orders. This month, the PMI index rose 4.7% but initial unemployment claims showed a slight increase. rose index issues at 52.6 suggests factory activity improved, but job claims rose to 240k and ADP came in at 96k—not recessionary by themselves, but enough to keep investors sensitive to weak earnings and guidance.

Investor takeaway: If both indicators were up, it would suggest a strong, expanding economy. With PMI up and unemployment down, investors are assuming these are initial signs of an economic slowdown versus a crash.

ECONOMIC UPDATE

What’s happened this week

ADP private payrolls (Jan): +96,000. Cooler hiring momentum can help markets price a gentler Fed path—but ADP is noisy vs. official payrolls.

Initial jobless claims: 240,000 (up). Higher claims can reinforce the idea that labor is easing, which typically supports bonds and rate-sensitive equities—until it becomes too weak.

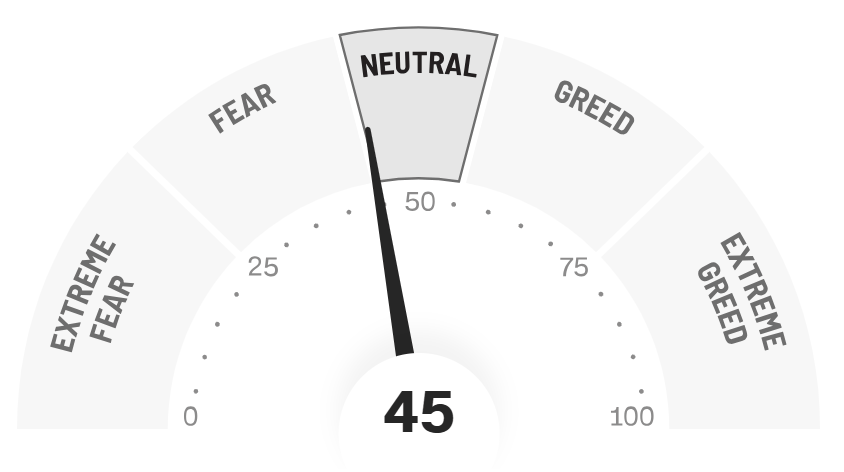

Consumer sentiment: 45. Consumer sentiment rose a bit to land in the neutral range. Mixed market results and economic data leaves us guessing

What’s coming next week

January Jobs Report (rescheduled): Wed, Feb 11. The market will treat this as the week’s main macro catalyst (rates + equities).

CPI (and other inflation-related prints). Inflation is still the key gating factor for cuts; any upside surprise can re-tighten financial conditions quickly.

STOCKS OF THE WEEK

Top Performing S&P 500 Stocks

Teradyne $TER ( ▼ 2.9% ) (+19.15% 5D) — Semiconductor equipment/test names rebounded with the late-week tech bid; investors also continued to favor “AI infrastructure” beneficiaries.

Biogen $BIIB ( ▼ 0.46% ) (+14.19% 5D) — Biopharma strength this week likely reflected a risk-on bounce plus stock-specific news flow; worth reviewing any company updates if you hold it.

Super Micro Computer $SMCI ( ▼ 1.41% ) (+14.14% 5D) — Still tightly linked to AI server demand and data center spend expectations; tends to move with the market’s AI capex narrative.

CHART OF THE WEEK

Second Jobs Becoming the Norm

Since 2015, average weekly hours worked in the United States have trended down, outside of the post pandemic shock (2020 - 2021). Subsequently, the number of Americans holding multiple jobs has matched the hours worked pattern, but in the opposite direction.

This shift in labor market dynamics will be hurtful to American families. The logistics of working multiple jobs means less time spent with family and more stress for working parents as they navigate rising costs of living.

LATEST ARTICLES

Investing for your children series

Part 1: Custodial Accounts (UTMA/UGMA)

Part 2: Custodial IRAs