Struggling with finances is an experience almost all of us go through but some of us deal with prolonged issues. We continue to struggle no matter what we try. Even worse, we don’t know why we fall off track every time we start a new budget or commit to a savings goa.. When we don’t identify the psychological issues that impact our relationship with money, we are almost guaranteed to not reach your intended financial destination.

The silent companion that holds you back could be generational financial trauma - the fear, anxiety, shame, or even guilt around money that’s passed down from previous generations. We understand how circumstances and events from our childhood shape who we are, but there isn’t enough conversation about specific financial circumstances and how they can impact your well-being if they’re never addressed.

The two environments that cause financial trauma throughout our lives are restrictions from scarcity or the lack of knowledge from harsh secrecy and control over finances.

“We Never Had Enough Money”

A USC study finds that people who faced childhood financial hardship show anxiety and loneliness nearly 20 years earlier than peers who grew up financially secure.1 If you grew up not having enough food, clothes, or lights being cut off, the impacts of these circumstances don’t leave you just because you turn 18. This consistent fear and anxiety can contribute to poor mental health and depression later in life.

Making enough money as an adult isn’t the cure for this ailment. Adults who experienced financial instability as children often exhibit chronic anxiety around money, regardless of their current income level.2 Generational Financial trauma doesn’t loosen its grip just because you’re out of the situation that caused it.

“We Never Talked About Money”

This situation more subtle. Your family could have enough money but if money is never discussed in the home, that environment still creates financial trauma.

A US Bank survey showed over 63% of parents said they avoid conversations about money with their kids altogether.3 Parents would rather talk politics with their kids rather than discuss their finances. Many of our parents were dealing with their own financial trauma, whether they know it or not. They avoid money conversations because they didn’t think it was necessary, shameful because they aren’t where they want to be financially, or believe they don’t have enough knowledge to do so.

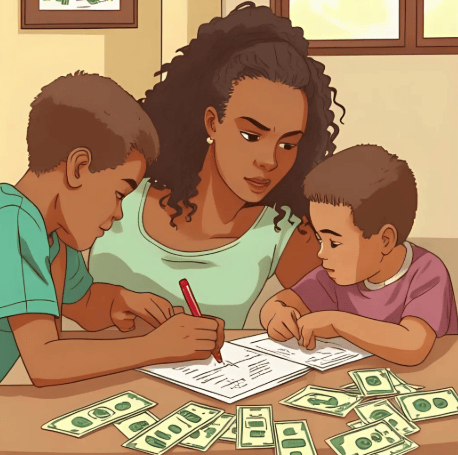

All parents must talk to their kids about money to have a real chance at leaving a financial legacy. Research from Cambridge University shows that money habits are formed by age 7.4 “By the age of seven, most children have grasped how to recognize the value of money and to count it out.” This study goes on to say the habits of saving and spending are developed by this age. Most parents don’t think to start this early.

How This Trauma Shows Up

The silent trauma shows up in many ways. What could look like simply poor financial management could be symptoms of deeply rooted financial trauma.

Hard to have financial discussions with your spouse.

Avoid putting a budget together.

Set financial goals—but never act on them.

Feel guilt when spending, even on necessities.

Over-saving and hoarding money out of fear of losing it.

Avoid investing out of fear of losing everything.

Struggling to set financial boundaries with extended family.

Living paycheck to paycheck, even with a six-figure income, because your habits are rooted in survival, not strategy.

How to Heal

Step 1: Start with Awareness

These questions are for the purpose of becoming aware of the environment and/or people who have contributed to your financial trauma. This isn’t to blame anyone but to identify where you are on your financial journey an back-track to the source. From there, we move to the healing process.

Ask yourself:

Where did I learn my money habits?

Who shaped my beliefs about what I deserve financially?

What did I learn about money growing up?

What messages did you receive—spoken or unspoken?

Was money a source of stress, control, shame or confusion?

Step 2: Open the Conversation

If you’re in a relationship, talk about what money felt like growing up. Did your parents fight about it? Hide it? Avoid it? That context matters.

In your own household, commit to making money a topic that is honest, frequent, and free from shame. Whether it’s with your spouse, kids, or even friends—transparency heals.

Step 3: Build a System That Puts You in Control

Create a structure that helps you feel confident. There’s a benefit to removing yourself from your money, both emotionally and practically. Understand that money is a tool you use to live the life you desire. Not a force meant to control you.

Automate your investing and savings.

Set yourself up to not have to make financial decisions over and over. By automating the amounts saved out of your pay, you build wealth on auto-pilot.

Have separate accounts

Use the 5-Account system to organize your cash. An account for bills, discretionary spending, short-term savings, long-term savings, and emergency fund. That clarity alone reduces stress and gives you breathing room to break the cycle.

Step 4: Break the Cycle and Rewrite your Legacy

Always remember how important it is to financially train your children. People are not aware of how young children need to start learning about finances. A University of Cambridge study found by the age of seven, most children are capable of grasping the value of money, delayed gratification, and understanding some choices are irreversible or will cause them problems in the future.5

Seven seems too young. But though a child might not have the ability to earn money, think about this: By age seven, a child can get a sense of scarcity or abundance. They can start to realize they don’t have the toys their friends have or how often they receive a “no” when they ask for something. I didn’t think age 5 and 6 were appropriate ages to have money conversations but this research has changed my mind. It’s suggested to give children coins around age four so they can experience spending and saving so they can experience the positive and negative consequences associated with money.

We think adulthood is about moving forward but some parts of it have to be about looking back and processing what we’ve experienced. Have the necessary reflection so you have the ability to move forward.

It’s important to be honest and call out the financial stress you’ve experienced in your childhood and not let the silent companion of generational financial trauma drain the happiness from your life.

References

chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://kidwealth.com/wp-content/uploads/habits-set-by-age-seven-pr-220513-final.pdf