Table of Contents

The current craze in the market is this “AI Bubble”. The AI boom has caused billions of dollars to be invested in every aspect surrounding this new technology. Energy, real estate, computer chip design and manufacturing, servers, database management, specific artificial intelligence companies, banks… so many industries are caught up in this arms race to make America the leader in AI tech. And the boom is just getting started.

What Makes it a Bubble?

A market bubble is when the price of the market is well above the true value of the market. This is caused by euphoria surrounding a new technology which is perceived to disrupt the current market. But the values of these companies invested in AI aren’t the problem by itself.

The big issue? The AI demand isn’t here yet.

The scary thing about this potential bubble is the amount of money committed to building the infrastructure without the demand being proven, just projected. Sure, AI is impressive and useful, but is the demand going to be enough to justify the billions being spent?

This is the fun and fear of investing, making assumptions about the future. Reasonable assumptions keep you safe while overly optimistic assumptions leave you broke.

I Scratch Your Back, You Scratch Mine?

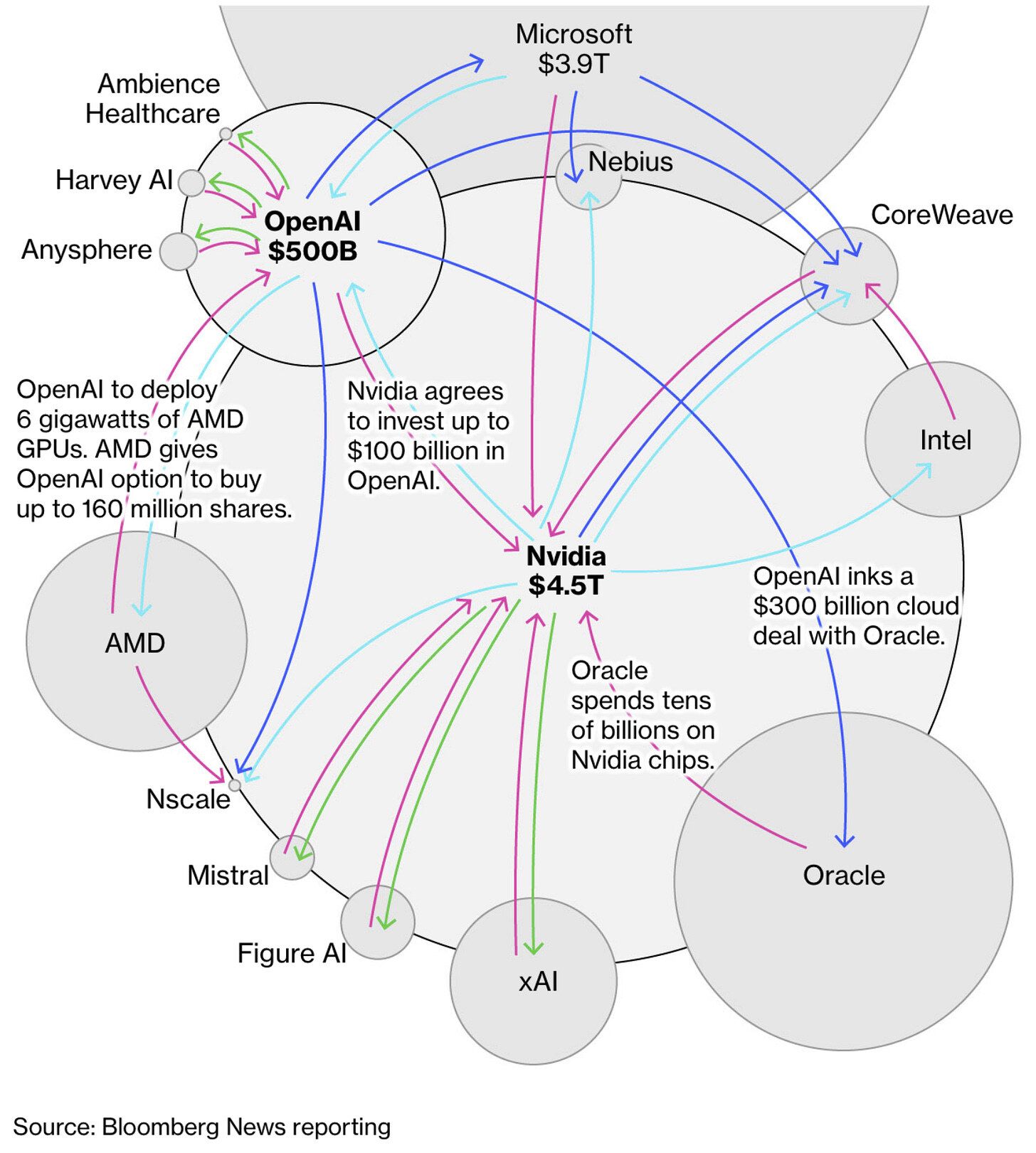

The next stage of this justified concern are the number and magnitude of the circular transactions between the AI companies leading the charge. As the graphic below shows, there’s a complex web of transactions that are a combination of investments and purchase commitments. At a closer glance, these are financing agreements hidden as investments and purchase commitments.

The most significant transactions in question

Nvidia → OpenAI → Nvidia

In September 2025, Nvidia agreed to invest 100$B in OpenAI. OpenAI committed to buying large volumes of Nvidia’s AI chips and systems.

Problem - OpenAI can’t afford to buy Nvidia’s AI chips. Nvidia is giving them money through an “investment” just for that money to come back to them in future years for purchase of the chips.

OpenAI → AMD → OpenAI

A deal was struck for a large chip purchase. OpenAI will become one of AMD’s larges shareholders with the option to buy up to 10% of AMD stocks.

Problem - though not the same as the Nvidia deal, it is similar in that there is money potentially going back and forth. OpenAI can fund the purchase of AMD chips from buying stock in AMD, then selling the stock for cash or borrow against the stock to fund the purchase.

Oracle → OpenAI

Multi-billion dollar deal for leasing computing power. A $30 billion per year agreement where Oracle will build data centers and lease them to OpenAI.

Problem - Oracle has to spend between $88B-$100B over the next four years to build out the infrastructure in this agreement. They will have to raise significant debt and recently completed an $18B round of debt to fund the 1st phase. It will be years before they realize revenue from this project.

Nvidia → Intel

Nvidia invested $5B in Intel, acquiring 4% to support AI chip production

Problem - Cross investment between competitors presents the risk that valuations don’t reflect real market demand but rather financial engineering. This investment reduces the available shares of Intel, artificially increasing the demand for the remaining shares.

Nvidia → CoreWeave → OpenAI

Nvidia invested in CoreWeave and now owns more than 5% of the company. CoreWeave signed a deal worth up to $11.9B with OpenAI. CoreWeave has purchased billions worth of hardware from Nvidia.

Problem - These deals create “revenue” without proof of the demand supporting these deals.

Today, OpenAI can’t afford any of their purchasing and leasing agreements with Nvidia, AMD, or Oracle, so they got creative by arranging a mix of equity and purchasing deals to support their future obligations.

Where is the Money Coming from?

Of the transactions I detailed above, Nvidia is the only company with enough profits to support their obligations in this web of back scratching arrangements. Even though they’ll likely finance some of these obligations, all other companies must finance these infrastructure investments.

A sort of “ghost factor” is the amount of money being borrowed from private credit institutions. PC’s are non-bank lenders that provide loans directly to companies, bypassing public markets. These are another form of private equity firms. Because these are private institutions, the public doesn’t know the exact figure of financing being used to fund AI infrastructure. In recent years, banks have increased their lending to PC’s to keep the activity needed to support our economy. As of mid-2025, an estimated $300 billion had been borrowed by PC’s from public banking institutions.1

What’s the True Demand of AI?

Currently, 61% of U.S. adults have used AI in the last six months and 19% of them use it daily.2 This could signal very strong demand as the industry matures. Here are the threats to AI demand growth: How much AI will we really need and do we need it enough to pay for it?

These legitimate threats are detailed by a few details. 91% of AI users utilize general AI tools for nearly every task, even though there are AI tools created for many of those specific tasks. This trend shows consumers lean towards AI products with existing distributions such as Google’s Gemini and our familiarity with ChatGPT since its essentially the first chatbot pushed to the general market. Many of these billions are being spent on specific AI tools. These will need to be demanded at the enterprise level for it to make sense. The everyday consume hasn’t proven to desire these tools.

Only 3% of chatbot users are paying customers. So What’s the true demand for people willing to pay for upgraded chatbots? Without the adequate use for premium chatbots, much of this investment will fall flat as it will fail to bring in revenues to support the investment.

Without the adequate utility and desire to have upgraded access to AI, all of these investments will prove to be very similar to what caused the dot com bubble crash in March of 2000, leading to 10 years of no market gain, the Lost Decade. When these companies and the greater US economy realize these billons invested in infrastructure were not necessary, the market will crash hard.

It’s important to keep in mind that AI is still a new industry. There is so much to be settled over the next 10 years. And even then, we’d probably still be in the early stages of the industry. If the US market doesn’t prove to demand AI at the vast level its estimated to be within the next three to five years, this bubble could pop similar to 1929. If so, life wouldn’t be cute in the US for some time.